Neoliberalism vs. China as model for the developing world

A working paper

Ali Kadri*

*NUS and LSE

Indeed, development requires democracy; however, not any democracy and certainly not selective or European-styled democratic processes. Selective democracy, the rule of the few personifying capital is not democracy. Similarly, for a central working class to vote for an imperial government that bombs and invades a developing country is not democracy. A working class besotted with the one time voting procedure reproduces capital and its more intensified form, imperialism. A vote for the Euro-American wars of encroachment (Kadri 2015) is a vote for a share of imperial rents. The central working class casts a vote for the imperialist class, which violently under-price and overconsume man and nature. Needless to say, cheaper under-priced commodities from the developing world buttress the purchasing power of central wage earners. And as material circumstances influence consciousness, the central working class adopts an ideological prism that mirrors the short-termism of corporate profit making. In popular culture, the maxim ‘what is good for General Motors is good for America’ best summarises its ethos.

The central working class is, to be sure, a class that conjointly with capital reduces its own necessary labour by reducing, albeit by means of imperialist violence, the necessary labour of other hegemonised working classes to below subsistence. Super-exploitation, the long working hours for low wages in industrial accumulation (Lauesen 2018), or commercial exploitation, the wars of encroachment at the heart of militaristic accumulation (Kadri 2019), bolster global surplus labour, the foundation of surplus value. Although both exploitative regimes are forms of wage slavery, wars of encroachment curtail the state and hijack en masse the power people exercise over their resources. Higher plateaus of surplus value characterise commercial exploitation because the weakening or destruction of states de-subjectify the masses/labour in the value relationship. Modern forms of commercial exploitation, the subjugation and destruction of states are magnifications of older forms of slavery. Moreover, militarism bears upon demographic shifts and growth rates through population expulsions, and relative or absolute depopulation; hence, commercial exploitation reduces necessary labour piecemeal and outright by reducing the numbers of the reserve army of labour.

Now as then, the selectively democratic lot, the central working class organically tied to capital, assume that underlings are simply part of the natural order. They overlook history and forfeit the social responsibility to question the prerequisites of capitalist production, the war, child or slave labour like conditions or the environmental carnage. And if they do for reasons of second hand sentiment, they inculpate a false or reified subject. It is either human nature or market forces, but never capital.

For instance, they pay the one dollar for the can of coke, but do not question whether the cheap tin relates to war in the Congo, the cheap sugar cane involves child labour, and the cheapened costs of unpaid labour and pollutants associated with production before and after consumption, raise expenses over the lifecycle of society. In real time, in the time it takes to reproduce society, a coke can would cost far in excess of that one dollar paid at the moment of sale. The central working classes focus on fantasies of fair-trade, trash sorting and greening the environment, all impossibilities under capital, and simply overlook the value-relations, the determinedly waste producing relations, instantiated in the momentary act of consumption. Beyond the cant of second-hand sentiment, they do not question the political measures their ruling political class implements to produce the cheap things they consume. Just as they detach themselves from the overwhelming waste emitted in production, they cast that ballot and literally detach themselves from the political process. They do so because as beneficiaries of imperialism, their consumption bundle and savings rise by the intensity of super and commercial exploitation. They systemically, also systematically, re-elect an imperialist class to do whatever it takes to protect their ‘way of life.’ Although that ‘way of life’ is rooted in a highly entropic system whose overproduction reduces their own quality of life, the rate at which life’s auto-consumption proceeds in peripheral formations exceeds the rate experienced in central formations. The costs of poverty, pollution and wars in the developing world are more costly relative to its limited resources. Immersed in social recognition arising from conspicuous consumption, the central working class acclimates itself to the fact that imperialism and eco-imperialism inflict greater damage upon the natural underlings.

Doubtless, the ongoing social and environmental calamity carries over by a dominant ideology. The pro forma concepts winnowed from pervasive positivism, and the current received-theory, are all about the alleged efficient use or not enough resources for everyone; subsequently, in a world of scarcity, the select lot ‘justly war’ against the developing world to protect their way of life. They are the ‘lifebuoy’ of civilisation, and if many from the Third World jump on board, humanity will altogether sink (Hardin 1968). As befitting of an ideology that turns reality upside down, the real world happens to be a planet plagued by overproduction crises. Waste produced by waste accumulation, which also produces consumerist man alongside the consumption item, abounds. Additionally, imposed scarcity, a social reality constructed to differentiate labour by politicising and weaponizing identity, also abounds. In terms of real physical scarcity, not even oil is scarce.

In the absence of labour’s historical agency, capital’s cost minimisation, the production of waste for profit, becomes the lynchpin of the system. The reification is complete and the logical form assumes a physical form. Value relations turn into waste relations, the ruling class becomes the wasting class and the working class becomes the wasted class. The absurdity of capital’s mainstream logic, the two-dimensional diagrammatic in which prices clear excess commodities, becomes more and more a condition in which the excess commodity to be cleared is labour power and its bearer living labour. So far, the principal output of the capital relationship has been wasted lives in wars, austerity and pollutants that waste lives. In the contradiction between a capital that grows by replacing living with dead labour while the sturdy currents of demographic growth in areas prohibited from modernisation expand unabated, the biggest industry becomes that of resolving the contradiction between capital and population growth. Imperialist wars and austerity not just solve the disparity between the development of productive forces and the accumulation of capital on the one side, and the division of colonies and spheres of influence for finance capital on the other, as per Lenin (1916), they also address the requirements for indefinite growth by creating an industry of pure waste, a militarism whose products are the premature dead, a commodity produced by the literal infusion of living with dead labour, and which mediates the capital-population contradiction.

Capitalists are personified capital (Marx 1867). However, the introjection of the rule of capital by the central working class also makes it a personification of capital. Capital, a commodity presupposed by a social relation, a substance and a subject, in the process of self-expansion and self-realisation thrusts itself forward by its own reason or ideological arsenal. It does so by the stock of accumulated historical surplus value, including, the store of received knowledge, ideology or store of culture at its disposal, and its pile of thingified people. The thingification is contingent upon the degree to which socialist ideology ebbs. That so many people have adopted the reason of the commodity, or have become things as per the phenomenon of alienation (Meszaros 1970), this acquisition of the commodity fetish of a life of its own may be the only viable explanation for the outstanding devastation of man and nature. Only things, not humans, unquestionably bring about their own destruction.

Furthermore, the rule of commodities, or the state in which people uncritically assimilate the rule of capital, is the ultimate form of authoritarianism. The rule of a thing, the commodity, upon things, the thingified humans, is the furthest of all positions from democracy. Correspondingly, the development attendant upon the consumption of commodities by commodities is the type of development that only occurs under a so-called democracy reigned over by commodities. Humans as actual and potential waste determinedly, as opposed to by a question of degree, produce and consume waste. Moreover, the worker transmuted into commodity exhibits a consciousness whose horizon is capped by the prospects of immediate consumption, including the consumption of oneself. In a world of socialist ideological defeat, the prospective of labour metamorphosing into historical agency to re-organise man and nature would wither if it was not for the counteracting systemic tendency that things pass only the value contained in them in production.

The thingification of humans is not solely a central phenomenon, as in European or white. Whiteness and centrality are constructs of capital with tentacles all over but whose key structure is nonetheless Europe, NATO and other instruments of capital. To set the record straight for ‘the politically correct’ modern slave owners, Mobuto and MBS are whiter than many white people. Still, variants of selective democracy are also superimposed upon the developing world. Democracy per se becomes a commodification process to be exported from the core to the periphery. Iraq’s democracy after occupation serves to illustrate the point. The US bombs, starves, invades, rewrites the constitution empowering sectarian and ethnic cultural forms as purveyors of rent from the state, setting the stage for inter-sectarian fighting for years to come. Iraqis also cast that vote for the sectarian lackey of imperialism to do whatever to provide jobs for some of his sect members at the expense of other sect members. The dormant or flaring inter-working class war reduces the politics and the wage share of Iraqis altogether. The working-class dividedness also weakens the Iraqi state by the loss of security and sovereignty arising upon the living insecurity of the working class. The rush of the sect to acquire a bigger share of a dwindling income on the basis of its weight in the state, holds the weak state hostage to imperialist strategy. The true voters in the case of Iraq are the Euro-US alliance. The victors of the cold war adopted the historical alternative for Iraq, the real vote cast in real historical time, while the vote of the vanquished Iraqi population is a mere ornament of modern day slavery.

However, unlike the white privileged class of the centre, imperialism deprives the Iraqi and similar masses not only of their control over resources, but comparatively of much of their lives or longevity. Imperialism often consumes the peripheral comprador, the labour aristocrat and possibly the whole of social nature, lock, stock and barrel. A hinterland, subjected to militaristic accumulation, the imperialism as condensed capital, spares nothing; whereas in the centre its labour aristocrats work hand in glove with capital to boost the imperialist campaigns. The prematurely wasted life is itself a product of militarism, just as a coke can is a product of the Coca-Cola corporation and industrialism. The more cokes and wasted-lives are consumed, the more returns capital generates. The unrelenting assault of imperialism, hitherto the insatiable meatgrinder, more frequently de-commodifies peripheral labour resurrecting the commons again and again as tools and means in anti-imperialist resistance. Because machines and people as things do not produce surplus value, capital in a roundabout way elicits the development of revolutionary consciousness in places like Iraq. The dynamics of the labour process undergirding surplus value require a labouring class that demands its rights just as it demands that people become things. Capital, by its objective stock of commodity’s reason, erects labour as subject in the value relationship only to be crushed. The Marxian business cycle is not a political cycle in the putative stop-go policies; it is a value cycle determined by the class struggle. As an adequate theory of value should contain a concept of organic change identical with qualitative change (Niebyl 1940), measuring value transfers to the imperialist centre in dollar terms, often by western Marxists, reduces the contribution of cheapened deaths over 500 years to nearly nothing. The imperialist slaughter is the primary predicate of capital. It is all the wealth qua waste not by the measures of machine outputs in dollars, but in the value of the subject. Facetiously, with Marxists friends pricing imperialism at 120 Billion US$, who needs the white supremacists. Accordingly, unlike the smugly paid Northern foot soldiers of empire, the Southerners and their nature are to be consumed in production at a much higher metabolic rate; if not by war, then by austerity and inordinate amounts of pollution and environmental degradation. Profits emerge as a higher dialectical unity of labour and capital shaped by resurrected revolutionary consciousness.

With regard to the latter point, just as imperialism renames its wars of encroachment as responsibility to protect, R2P, it now names the intensification of the environmental assault on the South a ‘Global Green New Deal’ (UNCTAD 2019). In one of mainstream’s more pernicious fairy-tale, the world deploys ‘the eight trillion US$ of its sovereign funds’ to finance the greening of the planet for sustainable development. Capital, the centuries of European colonial and ongoing massacres, the relation whose law of value fashions the condition for profits by destroying man and nature, is supposed to undergo a volte face and to discipline itself for the sake mankind. Crises of overproduction necessitating massive underutilisation or the barring of additional resource mobilisation by outright violence are supposed to suddenly disappear. Not that it is an insult to anyone’s intelligence to humanise the rule of commodities, but the very idea of lowering profit rates to the low levels of those exhibited by the long standing German family businesses so that the environment could be served, that fascist platitude of cramming reality into an arithmetic mean, not even an algebraic mean of profit rates, is ultra-nationalist corporatism. Under National socialism, Schacht’s monetary policy of free money for full employment worked only because Europe abetted the process to hold down the Soviet Union, the new ‘black people’ according to Losurdo (2019), or because ‘the superfluous’ population could be exterminated. At any rate, the superfluous population continues to be mowed down by wars and sickened by nature. The greenings of the planet under the rule of capital are clichés of an insidious white supremacy. The low profit rates over the long run in which the empty logics of the widow’s cruse, or the rising wages according with rising productivity, work only for the whites as they eliminate the excessive population and the environment supporting the global reproduction of that population in their own non-white strata or in the developing world. The Veblenian consumption trap couched in the language of social democracy, in which the developed world exhibits schadenfreude as the developing world perishes at faster rates, is neither an economic nor a political democracy.

Democracy is the political form by which power is exercised. The democracy required for all round development is a popular democracy. It is what transpires in the class struggle in favour of labour or the measure by which labour fares in the balance of power of the class struggle at the bosom of the state. The brace of popular democracy is the sovereignty built upon the solid foundation of working class freedom from want. Once latched to the institution of the state, the organs of labour oversee each step in the social production and redistribution process. Labour votes daily in state action. Democracy is not labour as ‘an’ organic constituent of the state, it is ‘the’ organic constituent of the state. The vote of the working class is not cast one time every few years by un-historical individuals whose medium is capital. The workers vote is consistently cast by the politics of the state to steer policy and divert resources to labour. Such is the democracy responsible for development in China.

Unlike India where the caloric intake for much of the rural population remains below the Sub-Saharan levels despite two decades of around 4.5 percent yearly average growth (Patnaik 2018), China’s standards of living have steadily risen. In much of the developing world, no matter the growth rates, high or low over the last four decades, one witnesses either higher relative or absolute poverty. Contrariwise, Chinese development, dubbed a miracle, alleviated poverty. It is rather a real and not an inexplicable miracle. Furthermore, unlike the dominant dictum that attributes the Chinese breakthrough to the market reforms of 1980, the process began as early as 1949. Post facto, these 1980 measures were manifestations of resilient socialist adjustments to China’s securitisation. As to the Maoist period, the real yearly average rate of growth was nearly 6 percent until 1977. That rate would have been higher if we were to smooth the huge slump of 1961 and 1962 – the years of parting with the Soviet Union - which would otherwise bring the yearly average significantly closer to the 8 percent rate experienced since 1980 (National Bureau of Statistics - China, various years).

There are two issues of note here. First, the Maoist period built the foundation of the knowledge economy, which would later prepare China to internalise advanced technology and exhibit enough productive capacity to become the factory of the world. In technical jargon, the significant Chinese elasticity of supply arising after 1980 did not spring from thin air. It had roots in the social and productive infrastructure built under Mao, specifically self-sufficiency in agricultural production, which freed the hands of the state to finance industry and garner science-laden productive resources. The past was alive in the present and, to be sure, it was neither the person of Mao nor Deng, but revolutionary ideology that charted the recent course of history. Whether Deng’s cat was catching mice or whether China was feeling the stones as it crossed the river, it did so under the ironclad fist of the communist party and its realistic thought. To speak differently, to falsify the structural continuity in modern Chinese history is an ideological position that aligns with imperialism.

Secondly, unlike the developing world where the war of national liberation was more about the ‘national’ than the ‘liberation,’ the latter term filters into an internationalism that emancipates man, China’s national liberation war, its development being part of its security structure, doubled for international anti-imperialist war. At first, it was Mao’s visceral internationalism. Later, its socialism with Chinese characteristics, which in most cases meant a publicly owned or controlled private sector, combined with its immense structure, its nationalism and self-liberation transmuted into internationalism. The more China developed and improved its living conditions qua security, the more the global power composition shifted against the imperialist centre. At later stages of its development, its strategy of all round internal development, as aptly envisioned by Chairman Mao, exteriorised in development for others and peace abroad. Furthermore, by reasserting the rights of people to sovereignty in Syria, Iran and Venezuela, its national development transpires into internationalism.

A posteriori, popular democracy surfaces as the masses in China exert power over the state to redistribute in their favour and, of late, to preserve the environment. Although the nuclear deterrent is means for sovereignty, the real security bolstering sovereignty is the steady development imparted upon the living security of the working class. On its own, the supersonic nuclear weapon displayed in China’s military parade on its 70th anniversary is just inanimate matter. The communist party is aware of that, and as Lin Biao (1965) had rightly remarked, ‘China has a spiritual atom bomb, the revolutionary consciousness that people possess, which is a far more powerful and useful weapon than the physical atom bomb.’ The directional causality is pellucid. In a process of accumulation by waste, imperialism would necessarily aggress and waste China, irrespective of whether China is capitalist or communist so long as it accumulates the national capital formation. For China, it is preferable to fight a people’s war of self-defence with more sophisticated weaponry.

However, despite its success, little is done to exhibit the anti-neoliberal macro-foundations of the Chinese model. The reason may be that just as China quietly climbed, it expects other by the demonstration effect and under its growing international clout to replicate its experience. Another reason may be that China has vast financial resources at its disposal and, its provocative ownership of assets in an otherwise US-led capital owned/controlled world, undermine the cornerstone of capital’s power, its private property. Already China finances Iran and Venezuela against the US-imposed embargo to overcome the sort of financial containment that was the Achilles heel of the Soviet bloc. Whatever the reasons for its resilience may be, and many will be valid, the interface between China’s actual power as it erodes the ideological heritage of the Western hemisphere, the conceptual stock that promoted capital’s expansion for over 500 years culminating in neoliberalism, will leave room for social alternatives to grow. As new ideas of socialisation arise upon new international relations in the global environment, the old wealth of Europe, its historical surplus value stocked not only in commodities, but in the current dicta such as others are of inferior races or cultures, will come undone. The reaction of US-led imperialism to redress the loss of ideological wealth, which is European in terms of structure and less so American, can likely be acted out with more imperialist violence led by the now rising fascist Europe. The US-European conglomeration cannot be weaned from a wealth principally bred by imperialist violence. Under the weight of fetishism, an orderly workout to disassemble empire that pre-empts the possibility of bigger conflagrations will prove difficult.

In China’s poverty alleviation, the social wage tallies with social productivity as opposed to the fiction of marginal productivity setting some micro wage relative to a price dictated by capital’s historical imperatives. Scarcity, free competition, prices clearing markets and full employment assumptions will be laughed out of social science. Chimeras such as Serbs must fight Croats and Sunnis-Shias because of historical hatred, or that tribalism in Africa is primordial and awaits the bombs of white man to let peace reign must disappear. Imperialism is sociological and the wealth of Europe is its dominant ideology. As developing countries adopt sovereign macro-policies and loosen the grip of empire, the transference between the declining power of empire and its declining image, its ideological power, become the ferment of a conceptual revolution.

In what follows, I will draw on some salient characteristics of the Chinese model to critique the conceptual constructs of neoliberalism. Evidently, I will not be able to cover the whole gamut of China’s development experience. Allegorically, China felt too many stones as it crossed the river, and although it crossed, it also tumbled here and there as well. That is why I will principally focus on the macroeconomic foundation of development as practiced by the Chinese communist party.

Situating the issues

The global crises disclosed after four decades of neoliberalism are phenomenal. They are yet to impose a reconsideration of the received mode of analysis based on the claim that economic development depends primarily on the creation of an enabling environment for the private sector, including free markets, and free flows of trade and finance, while restraining the social interventionist role of the state. Although developing countries were presumably set to develop after the implementation of neoliberal policies applied gradually as of the late 1980’s, ex-post evidence accumulated so far points to the contrary. Apart from China, most developing world growth has been anti-developmental. In the case of the poorest nations, growth was pinned almost entirely on the export of primary products and, in light of the variability in that alongside a foreign-capital biasing national institutions, indigenous resources have been permanently disengaged. Neoliberal development has been counterproductive, precarious and uneven, both within countries and across regions (Fine and Saad-Filho [2016]).

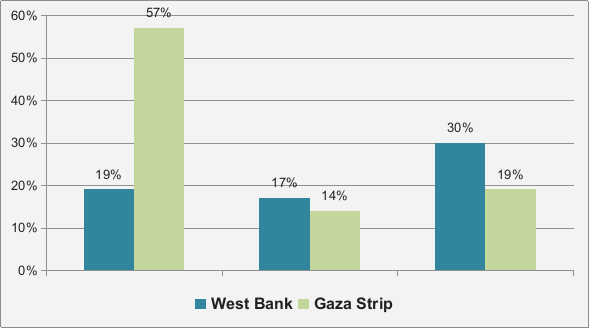

Socially inclusive growth, the new mantra of the International Financial Institutions (IFIs), does not logically include anyone in growth without the restitution of nationally-committed social agencies. Since the core of neoliberalism empowers financialised private-sector concerns over the social ones, and since private capital inherently exhibits stronger ties with the international financial markets, it does not follow to posit that growth will ever trickle down or be socially inclusive. Moreover, because profit-driven wealth depends on the simultaneous act of cost-reduction and rising productivity growth, and because openness generally decimates the latter condition, wealth will grow by the liquidation of national assets, a lower share of wages and or immiseration of the working population (Kadri 2019). The wage shares of much of the global working population has experienced steady decline since 1980 (ILO-KILM 2015 and 2019). Although on average developing world long-term growth rates were lower in comparison to the post-war age of capitalism, the profit rates were significant and rising (UN-WESS 2011; Milberg 2008; Fine 2010). That the sources of growth stem more from the share of wages rather than productivity growth gives new meaning to the Cambridge Golden rule, nearly all the additional growth goes to capital, implying the rate of profit grows at a positive rate, while the rate of growth in incomes is negative (Palpacuer 2008). This scenario often generates considerable inequality and reverse development. The obvious example would be Egypt, which after 30 years of 5 percent positive real GDP growth, experienced rising poverty, child malnutrition and revolts (UN 2010).

For reasons to do with space, let us posit that to construct socially inclusive and poverty alleviating macroeconomic frameworks or to improve the quality of productive capital, living standards and people’s institutions, two a priori hypotheses should be considered: first, the scope and scale of coordinated and purposeful economic activity concurring with working-class based policy. The sort of activity that mediates the national concerns into the regional or international ones (Nayyar 2008). The activity whose aim is to lift people from absolute poverty, which is best tested in relation to how effective is labour in the formulation of state policy. This is China’s contribution to the area of development as a human right. Secondly; yet more decidedly, a less widely recognised condition for development, which is security cum sovereignty. Security defined as the totality of peoples’ democratic and national securities that compose the substance of sovereignty. This second hypothesis revolves around the idea of how sovereignty, the synergy between the welfare of the population and national defence, transpires into autonomy over policy (Jenkins 2008). This condition prevails to a large degree in China.

The first hypothesis addresses the idea that in a globalised environment, sound development cannot take root in a single country while its neighbours are wallowing in disaster, or while imperialism uses methods of destroy-to-grab. The very concept working class negates the national identity. In other words, development should be rooted in a policy transcending the national framework and supported by common measures that ensure the welfare beyond national borders. These policies are working-peoples’ effected and designed measures. They are about the capture of value from an economic cycle that strengthens forms of resistance to imperialism or national resilience (Dragsbaek-Schmidt and Hersh 2018). In China, the rise in wages (wages in manufacturing trebled over the last 12 years [Trading economics 2019]) and the bridging of regional disparities were co-aligned with intra-regional investment and closer integration frameworks (Jacques 2012). Altogether, one observes a Chinese virtuous economic spiral upon which social tensions taper down; hence, solidifying the national front.

The second hypothesis highlights the sovereignty of a people over their human and natural resources. Although in today’s frame of neoliberal reference, that supposition does not count for much, it is worthwhile to recall, that such was a class and national liberation struggle right at a time when the developing world enjoyed more power in the international arena. The memories and symbols of class have stored the successes of these times. These could be readily re-ignited. In somewhat anachronic fashion, it is this second hypotheses that still coheres with the Chinese nationalist development model. Despite some transitional social and environmental costs, China’s nationalist development model outperforms the laissez-faire model of neoliberalism. To restate the standard refrain, it is only through the inclusion of China’s alleviation of poverty that the world poverty averages appear low (Jacques 2012).

The reason for the perverse neoliberal transformation in the developing world can be anything but straightforward. It may be attributed to social psychology or the adoption of obscurantist ideologies, frames of reference by which people inflict upon themselves undue levels of misery over long periods of time. Time, the continuum in which social action incrementally builds by the dominant ideology of capital, is partitioned by analytical reasoning and, alternatively, the masses may endure short-term pain for the promise of long-term happiness. The reason can also be less complex, as if people disdain the formulae of economics, the calculation of the rates of resource allocation or the arithmetic, by which their absolute and relative living standards decline over time vis-à-vis the perceived costs of overcoming divisive identity politics or revolutionary transitions. Whatever the reasons, class, the abstract by real social relation, the weight of history and power, the predicate of the social product in real time, vanishes under the received notions that individual behaviour and effort erected by the virtue of some cultural symbol, race or tradition, determine a ‘fair share’ of the wealth. Whereas wealth is determined by social time, the time into which peoples’ lives are crammed to produce, that reality escapes the working class by its lack of cohesiveness. The momentum of faulty conceptual construction already borne out in the eclecticism of mainstream theory and transfigured onto ideology finds little opposition in much of the Marxist theory rooted in Eurocentrism.

However, the mechanics of income transfers are as pellucid as the ostentatious displays of wealth. Even the conventional press feels at ease trumpeting the immense inequality, the one versus the ninety nine percent, albeit without emphasis upon the dividedness of the working class as the root cause of disparity. For instance, although job creation is key to poverty alleviation, there will be no mention that neoliberal policy retrenches public expansion and public investment, lowers the regulatory benchmark, the discipline of the excesses of the private sector, and unleashes short-gestation period investment that create little or no ‘decent’ jobs ( See Mishkin 2009 and Obstfeld 2009 for IMF positions on the unrelatedness of openness to welfare); but why decent jobs? As noted by the experience of the majority of countries, more jobs are created under the neoliberal recipe than otherwise, but these are overall poverty-wage jobs flourishing in the informal sector.

Under neoliberalism, the official unemployment rate shows remarkable improvement, albeit in the presence of rising poverty; as should naturally occur because the wage share is declining. By surrendering state investment and regulation to the externally-tied private sector, the sector whose capital circuit is the international market, the economy also sheds many of the decent jobs. This occurs because capital can foist its own criterion for labour demand. The privately constructed benchmark for hiring arises upon the productivity of a on non-existent or asocial-individual set against the money value he produces for the firm, as opposed to the real social man whose social productivity is the true criterion for job creation. Add to the faulty private measures for employment, the combination of higher taxes and less public investment combined with a monetary policy that supplies credit for financial class, and the share of wages can only experience a downward spiral. As wages drop below the historically determined decent subsistence levels, the economic process becomes hollow, the sort that generates economic growth alongside poverty and poverty employment. Uninterrupted hollow growth, the liquidation of human and natural resources to buttress profits is de-development or, lumpen development as per Gunder-Frank (1972).

To recognise what is lost under neoliberalism is to recognise what has been achieved under China’s sovereign development model (Saith 2008; De Haan2013). China exhibits an autonomous economy combining an expansive public sector growing side by side with a much smaller private sector (Gabriele 2020). It is an economy disciplined by restrictions on the capital account, control of management as opposed to markets, free economic zones inter-laced with an organic socialist economy, and other labour favouring rigidities. Here, I highlight rigidities to portray it in a positive light. The constructs of ‘flexible and rigid’ of the neoliberal vernacular are a jargon of deception. Neoliberalism is neither about a free product market nor about a flexible labour market. This absolutism pertains to logic but not history. Neoliberalism is a value drainage mechanism visited upon weak un-sovereign states. It more than encroaches on public assets and resources, and dissipates national resources. Instead of a virtuous productivity-rising and wage spiral determined by the power of the working class, to ensure higher a higher share of the surplus, one notices the fragmentation of labour or the flight of resources.

In addition to an effective state regulatory framework, the lingering rigidities from China’s socialist past had channelled a proportion of economic wealth into the social cushion necessary to hedge the private market mechanisms (Gabriele 2020). For instance, certain life-time employment contracts for the progeny of the national liberation war heroes and other job security measures that garner efficiency at both firm and social levels mitigated the transition to the mixed market. Assessing developments in the social structure of China, there was more continuity than discontinuity.

Relying on its principle of ‘Sustainability Led by Science and Technology,’ more than half of the tech-content of Chinese exports now emerges by national means (Cheng and Ding 2017). China is engaged with its more tech-advanced trading partners in a way that upgrades its own science-productivity content (Freeman 2018). China conducts itself in a similar manner with its partners in the least developed economies through its Belt and Road project (BRP). China’s infrastructural projects, in complement to the host productive sector, churn out higher productivity of output per capital invested in the developing world. China’s assertion of its particularity bolsters multiplicity. Its investment in infrastructure such roads, railroads, ports, dams and airports synergise local capacity. Just as it practiced a socialism with Chinese characteristics, it pollinates the knowledge sphere with a socialism that may yet flourish in a socialism with Arab or African characteristic.

That US imperialism destabilises Chinese partners along the BRP has an implacable bearing on the under-valorisation of global resources, on cheapening the inputs of the developing world. The US disrupts vital asset areas and resource flows along China’s trading routes. Its wars of destabilisation raise the rate of militaristic or financial rents, in contrast to the industrial and productivity rents of China. In the recent past, US-sponsored wars have tipped power balances in favour of the US-led camp and dollarized the planet. The higher risk and risk premia raise flows to the dollar zone and increase dollar assets and demand. The flows of surpluses into T-bills are significant but secondary to the category of US global imperial rents wrought from US strategic control, which afford it universal dollar-seigniorage.

Destabilising the BRP by infusing proxy wars to restructure power balances and expand fictitious credit (money without a corresponding real value), also engenders real-value snatch. Fictitious US capital prompts further imperialist expansion to underwrite the excess credit, while imperialist war, the pure waste economy, on its own creates new value and mobilises existing surpluses. The US entraps the real value produced elsewhere without effort through its control of finance and financial channels. Financial hegemony accelerates the turnover cycle of money capital (Hilferding 1910), forcing the real economy into a higher metabolic production plateau; the economy overconsumes cheaper natural and human inputs per unit of output. It lowers labour income shares in the social product, imposes debts to induce austerity, and manipulates capital flows to reduce the prices of national assets elsewhere. These are symptoms of dislocation under neoliberalism.

Neoliberalism injects insecurities that corrode autonomy and sovereignty. China dodged the trend. That China is sovereign and that China develops and that it could serve as a model is not only a matter conditioned by its size; it is principally how its social forces rearticulate to realise development. Specifically, China’s communist party is innately predisposed to national development through the state.

Neoliberalism and autonomy

Prior to neoliberalism or during the post-war age of capitalism, most economies derived a certain degree of autonomy from regulated capital and trade accounts. Development was about national resource retention, mobilisation and recirculation of real and financial wealth. As autonomy eroded in the neoliberal age, development faded. Much falsification of fact followed, especially as the contribution of national security, sovereignty and policy autonomy to development was clouded over by empirical studies that treated the historical agency in charge of national resources as the empirical equivalent of economic symbols such as tariff or quota reduction. After all, it is people organised in some form of social relation that impose tariffs, and it is the quality of these social relations, qua social classes, which constitute historical subjects, it the primacy of class that invites research. The mainstream economists treated people engaged in development as if they were things – and oddly they were vindicated insofar as capital was a personification of commodities, and or, labour’s ideology was that of capital’s. As commodified intellectuals they reasoned at the behest of the commodity. The logical forms purportedly reflecting economic variables and instruments such as tariffs, or interest rates acquired a life of their own and they dictated social processes. However, behind the movement of these prices, there were estranged institutions governed by the reason of the commodity as self-expanding value, manipulating social and thereafter economic conditions in the interest of the commodity and, not so much, the ‘perceived’ interest of a narrow minority. The truth of the matter is the social-natural calamity, or the overwhelming historical moment of waste, makes it in no one’s interests to remain stuck in the capital relationship.

Falsification of fact specifically flourished in describing the relative success enjoyed by the Asian first tier tigers. In much empirical research, security or the US military umbrella was treated formally, as if simply another variable in an equation, once positive and otherwise benign or bearing some measurable effect on development (Kadri 2017). It was not considered as a decisive historical act, the conjuncture of institutionalised decisions leading to increasing the rate of growth of the productive capital formation, whilst enhancing the share of labour from total income. It was not viewed in terms of an exercise of power in international relations mediating exigencies in the global accumulation of capital – here the role of Taiwan and South Korea in the containment of China. Whereas whatever success there may be can be attributed to their functional roles as imperialist police stations, their relative success was speciously attributed to the emulation of American free market and enterprise.

It is true that few countries enjoying a certain level of security by the extensions of global defence treaties, like the first-tier tigers, reap development benefits from the ‘market expansion side’ of capital accumulation – the preferential trade statuses they enjoy with the US and Europe. However, these states also serve as advanced US-securitisation bases in an outstanding cordon sanitaire or ‘as hyped-models of development to be mimicked by others,’ when paradoxically, because of overproduction and logically by the adding up fallacy, not ‘all countries’ can copy these Asian models. Often, the projection of these Asian success stories purposely confound development with hegemonic security ties, especially as development gathers the support of a population willing to self-sacrifice for empire. As a first tier Asian tiger serves to extend the hegemony of the US, it will receive much aid, albeit, to extend higher rates of commercial or super-exploitation to its more populated neighbours in South Asia. It will mean narrowly material as opposed to internationalism-infused development; development for the few well-armed northern states, South Korea and Taiwan, at the expense of a growing swathes of poorer countries around.

In making sure that South Korea should be part of a cordon sanitaire to contain Chinese advance, the US even tolerated the implementation of land reform, which was later crucial to decreasing income inequality and released resources for comprehensive development (Burmeister1990). In point of fact, the handful of developing countries that rose to first world rank had avoided the IFI’s neoliberalism or free market recipes and enjoyed significant imperialist privileges and aid. However, the autonomy they enjoyed is on loan and instrumentalised by US-led capital.

The reign of commodities

Mind-gripping ideas, in particular, the mystification of reality through strands of super-inflated individualistic and identity politics have clouded over the social nature of production. These have further distorted the cosmopolitan nature of human civilisation, the universality of knowledge and the political processes that command social development. The expansion of these cultural phenomena fulfil imperialism’s requirement for real underdevelopment and deprivation of cultural development. Intertwined with the imperialist military bases and NATO’s reach, these cultural spinoffs write off the security and autonomy or sovereignty (used interchangeably) of the subdued nations. Imperialism operates with the rationing of social infrastructures of knowledge, the barring of modernisation of the hinterland and education, in addition to masking over the true subject of history. The victory of the US in the cold war was a victory for that obfuscation. It was not the financial class that won, it was democracy. Planned markets controlled by labour through the state are said to have failed, and the smarter more efficient market of free enterprise won. History is not a chess game and what has really won was capital as the weight of history, the same old relation trailing from the long sixteenth century, the indefatigably aggressive force that tears down the walls protecting less developed formations. The glitz of capital’s war machine and consumerism has also prevailed. Whether through identification with power or by the plight of a superfluous population beseeching capital for an unpainful early death, a mass euthanasia, the post-cold war era reintroduced the reign of the commodity with full force. The absence of socialist alternatives or lack of ideological exposition to other successful social alternatives such as the Chinese, let mass consciousness slip into a state of defeatism.

On the economic plane and through resource divestiture, neoliberalism instilled inimical growth in the productive forces, including the productive capital stock, employment and growth in the incomes of the poorest working strata. Biased institutional change botched up broader participation in the decision-making process as the state retreated and vacated grounds for the imperialistically-funded civil society. Neoliberalism as an ideology does not function by selecting people who are corrupt and in the business of promoting their self-interests. An ideology creates the historical context into which it is only possible for corruption to grow; corruption defined as the transfer of public into private wealth.

Social remedies for the inequality and unemployment debacle, the only solution for labour absorption under capital, faded from the scene. The instruments of neoclassical economics, the conceptual tools of neoliberalism that set policy regimes and, the benchmarks for the formations of macro prices, such the exchange or interest rates, were conceived of as bereft of social agency and, just like the commodity cum fetish, with its aura to rule over society, people were treated as excessive things. All the same, macro-prices are instruments that serve the allocation of resources and the distribution of income according to the political and ideological power balances ruling the social structure. No serious effort was adopted to demystify the short leash extended to history by the commodity, not even as the crisis in nature reacted with vengeance against mankind.

The context for resource allocation

If we posit that poverty jobs are not jobs that the productive economy creates, but work that many conduct to simply remain alive, then the weak response in job creation to growth over the period 1980-2014 contradicts the law of labour demand as derived demand; measures exclude China (ILO-KILM 2015). This otherwise chronically low elasticity of labour demand to income illustrates that growth was hollow. The lower share of wages illustrates that income is politically generated rent (Marx 1867; Kalecki 1943). Weak and divided labour earns meagre social wages, irrespective of the supposed moral component propping wages; capital has no morals. The wage is social. Productivity is social and it presupposes the wealth level, but not the shares distributed to labour and capital. The high rate of decent work unemployment mirrors the anti-labour bias at the heart of dominant theory. The putative hypothesis states that labour demand is the sum total of each firm’s demand as it levels worker productivity with the wage rate; that is assuming particular productivity exists and is measurable, which is rather fantasy. Reverted to its mainstream theoretical reasons, unemployment is the product of an economic efficiency criterion that equates/identifies the private with the public spheres.

Nevertheless, declining investment quality, labour saving capital with high-tech composition, and slowing rates of growth in productive industrial stock and agriculture, sap demand for labour. More precarity emerges (Standing 2006). While central business-cycle recessions set upon the West every decade or so with two successive quarters of negative growth, the cycle of the developing world is intrinsically anaemic. It is underlaid by monetary and fiscal leakages, and a production process whose import dependency and labour-saving technology immanently shed labour. The expansion of poverty employment for the private sector, the sort of work that falls outside the effective units of labour required for production of commodities destined for exchange, is means of suppression and control. Job creation is subject to the hegemony of capital as labour demand adheres to capital’s primacy of politics. Capital calibrates the jobs it provides or subtracts with the steadiness of its rule in mind. The poverty jobs transmit high rates of profit, but altogether at much lesser rates than commercial exploitation or deaths by wars of encroachment and hunger.

The overwhelming majority of jobs no longer classify as work that delivers effective labour units in production, which sell on the market for a decent wage. The job market is a two-tier system of well-paid agents of capital unleashed against the immiserated masses. The command of capital over the cycle of labour power reproduction through pauperisation, de-subjectification, and quasi-enslavement, is more and more the corner stone of the labour process. It may be as well to recall that without publicly accountable production processes, and because what is efficient for the private sector is necessarily inefficient for the public sector, decent jobs and development fail to be met. The causes of failure are in the way power, control and decision making are articulated between the various classes, in particular the positioning of the working class vis-à-vis the imperialist class.

As to the business cycle, developing economies have been performing way below potential or have had to set resources aside. Capacity idles, demand for subsistence rises, penuries of basics abound. Neoliberalism hands down a higher rate of resource underutilisation to less autonomous and less capitalised formations. The regulation or formation of the price system in dependent economies follows the world exchange and interest rates, namely US-capital determined, in proportion to openness, as opposed to national forces shaping macro prices. China averts much of the diktat of world prices and imposes selective measures of openness, or it opens up as the economy withstands the shock. However, for security-exposed formations, the externally determined macro prices (world interest and exchange rates) shift resources into their externally integrated sectors. Their monetary policy to hold down the rate of inflation by keeping the interest rate unduly high, which otherwise arises upon the trade and fiscal deficits alongside external borrowing, consistently lowers the living wage for the majority. The lower wages happen not only because of the higher prices of essential commodities or low purchasing power, fighting inflation raises unemployment as credit rationing lowers demand and output altogether. It also lowers the wage share of labour not only because fewer people are employed, but also because the state taxes the workers to subsidise the pegged exchange rate as the rich transfer their overvalued national currencies abroad at the fixed dollar rate. The dollar peg subsidises the wealth of the rich more so than the bread of the poor. Rephrased, managing the exchange rate peg with the dollar furnishes the national comprador with a mechanism to shift national assets abroad through national currency subsidised by additional taxation or by a share of the declining wage bill.

Policies of condensed capital, the neoliberal policies, design incomes to flow as geopolitical rents that dichotomise a developing economy. Rents flow to a highly capitalised modern sector where few jobs relative to the capital are created and, in an adjunct manner, decent job expansion occurs mainly through patronage in the public sector. In public perception, patronage as a social pacification measure connotes inefficiency. However, in the absence of social welfare programmes, public employment meeting social concerns amounts to a long-term developmental payoff. Subjected to fiscal austerity and leakages, including real capital and labour flight, the public sector’s growth has been less than commensurate with high rate of new entrants into the labour force. The contradiction of capital with population growth is acute in Africa and the Arab world. Tangentially, the weak financial intermediation between money assets that accrue from geopolitically determined rents and the build-up of physical capital and a healthy rise in income associated with rising productivity (wealth), the rest of economy leans ever more heavily towards the service and informal/low pay sectors.

From the point of view of capital, inter-working class conflict spun around constructed identity or deepening labour force differentiation boosts the risks and the short term rents in all the economic sectors making the present more valuable than the future. Speculation and finance overwhelm industrial investment. In that sense, the scourge of identity politics, notably plays in favour of the capital and its comprador. But still, it may be relevant to recall the overarching condition of geopolitical risk and its impact on inter-temporal preferences, institutional capital-bias, and the already inherent uneven development, also contribute to making the financial rent fallout more valuable than investment in an industrial or an environmentally sound future. The combined effect of nationally bred divisions and externally imposed threats upon small weakened states write off the future. Needless to say, within an un-sovereign institutional context, presumptive redistribution allowing for lesser concentration of private wealth and greater interest in development is highly unlikely, save the presence of a working class. The comprador control the developing state while their assets are the liquidated national wealth stock lodged abroad in dollar form.

The financial returns of the comprador, pre-determined by geopolitical rent channels, are material grounds for their unity in imperialism and dividedness at home. Formulaically, the incremental growth of the dollar wealth of the comprador forces each of the comprador classes into a race to convert national assets into dollar assets, no matter the dire effect on production. The comprador deconstruct their own states setting the stage for the more surplus value-intense accumulation by waste (Meszaros 2005; Kadri 2019). Comprador capital is an inter-conflicting relationship that draws rents from dismantling the national productive structure at the behest of foreign powers. In other words, the comprador meets abroad in the common pool of dollar investment or savings, but collides at home over shares in rents.

Contrariwise, the wealth of China’s leading national class originates in national production and is national currency denominated. China’s capital recirculates nationally and rises as higher plateaus of living standards obtain to the working class. In weak states serving as repositories for raw material and war, the comprador’s inherent function is to liquidate labour. In its partnership with imperialism, the comprador acts to set aside or neutralise national resources that could bolster national platforms in international negotiations or raise competitiveness. The premature deaths or exodus of labour as a result of souring living conditions epitomises resource usurpation.

The neoliberal side of accumulation driving capital’s gains is to be found in the institutionally-imposed inter working-class divisions assuming various identities, which are reconstituted socially as a result of competition for rents around the state. In processes of blatant de-development or for states at lower ends of markets, these are financial or merchant rents as opposed to socially-abiding productivity generated rents. The former form of rent dissolves wealth, the latter builds it. Rent orchestrated by the dominant ideology surfaces in the disarticulation attendant upon the retreat of social consciousness as economic conditions worsen; not that the departures of consciousness from social being is unusual, but the degree to which the formal or metaphysical conceptualisation guide the making of events is unprecedented. Th forms of thought with which people fathom the environmental calamity, for instance, the idea that sorting trash more efficient machines help, are unreal and ahistorical.

Because of financialisation, the ideological response required to restore nationalism in the practice of development is more elusive than ever. Much of the phenomenal culture of consumerism, more aptly, self-consumption, is co-supportive of intra-national wars. Conflicts visited upon the developing world are industries of waste and means of imperial hegemony, which conjointly with the stresses that ensue from lack of labour-oriented institutional development further divorce the working class from active politics. Naturally, there will be no popular democracy of the sort that daily negotiates projects for the masses at the bosom of the state.

Circuitously, the usurpation of national resources mirrors the feebleness of the masses in the state. As trade and capital accounts are set free, developing countries’ control over their monetary/macro policy becomes a negotiated settlement measured in relation to the depth into which they sunk into foreign currency denominated debt. The symptom of central banks underwriting the expansion of credit to inflate asset prices, pegging to the dollar, financing internal borrowing with external savings, albeit, side by side with capital flight literally shrink output and the wage shares. The speculative pressure on real capital assets lay grounds for only ephemeral, or quickly gestating, investment. Consequently, developing countries distort the path of their productive assets depriving future generations of bequeathed wealth or holding future labour as collateral against fictitious - unpayable - debts.

China as élan for development

Chinese experience, its autonomy over policy, the nexus of security and development characterising its post-independence path, revolutionises development and sheds new understanding of the nature of the agency of development in relation to policy. China confronts an imperialism that has to raise the oppression, which boosts the rate of exploitation while holding to a higher degree of power that captures surpluses via the financial channels. Such imperialism thrives mainly by war. China is subjected to a protracted assault, especially as it alleviates poverty and nurtures the power to retain surplus through the development of its own finances (Kadri 2017). China’s technical development strengthened the grounds upon which the masses successfully fight a people’s war. In my discussion so far, the premise for always developing the capabilities of people’s war holds primacy because for US-led imperialism war is the state of becoming of its capital. Just as there was a monophysitism, a union of god and man in religious mythology, there is a union of militarism with the US-European capital formation. For the developing world, a twining of security and development, the kernel of the Chinese model, presents itself as an immediate alternative.

Conversely, instead of investment in infrastructure, and plant and equipment, the neoliberally reared model erodes autonomy and shifts the accent in development to stabilisation efforts, especially the stability of central capital’s rule; not peripheral, central, so that the destabilisation of the periphery often serves the stability and war revenues of central capital. Adherence to the conceptual framework of the mainstream sways resources away from social and economic pacts into the repressive state apparatus, which is the phenomenal brutality of the politics of neoliberalism and militarism, as opposed to the individualised cases of state-cruelty. By this I may draw on Libya or Iraq as for analogy, these regimes repressed hundreds or thousands of political opponents, but the US bombed and starved millions to death and gathered more power to conduct more of the ‘saving-people’ operations elsewhere! These are different planes of repression. It is the totality of capital and its belligerence, the structure of white US and Europe as opposed to the idea of whiteness, which imposes all modes of repressions downstream, including the practices of states acting in self-defence.

Immiseration, the womb of interworking class violence, is the womb of the power that stabilises the grounds for financially strapped, profit rate concerned, imperialism. Institutions remoulded with neoliberal concerns in mind, and developing under the onus of hollow and highly erratic economic growth, ‘privatise’ the state. The subaltern image of such rule is the growth of social schisms along identity fault-lines. Here is the springboard for the neoliberal income maldistribution and the political strongholds that privately own the public sector.

To formally address the interface of available resources to development without prioritising the type of the historical agency mediating the decision to develop is to be held hostage to the dominant concepts. The mainstream formalises the relationship between macro and social variables. These in turn become devoid of socio-historical content. Formalism is a relationship of variables to variables, as opposed to socially organised agents, the dynamic social relation in which every part is a dynamic whole of a larger whole. To be sure, the so-called mathematical rigour of mainstream economics was a pernicious attempt to conceal ideological proclivity. In particular, the outlandish proposition that growth will trickle down without labour’s command over the channels of allocation and distribution. Most important, the economic efficiency criterion of the mainstream is set against non-existent atomistic, abstract agents, or private rather than social considerations; once more, formal and unreal. Capital generates wealth and much has been produced under private sector tutelage, foremost is the un-compensable damage to man and nature, which far exceeds any benefits of capital.

The replication of that model requires a re-articulation of the power structure in favour of working people, which co-laterally implies a joint national front against the comprador and its patron imperialism. Although much comprador is turning to China for financing, the growth of China itself undercuts the foundation of compradorial classes because it undermines US-led hegemony and financialisation. In terms of surplus retention, the emulation of China requires industrial, trade and capital accounts measures that lock in resources and recirculate the surplus value nationally (Weeks 2000). Regulated financial flows are the safety latch of Chinese development. Other points of political economy from the imperialistically homogenised economy that the Chinese model overcame can be tersely put as follows.

Investment and capital formations

Investment, more precisely the net incremental increase to capital formation, builds by the demands of growth and returns. Under the weight of shrinking credit to the working class and jobs, neither conditions are adequate to induce investment in long-term productive capital. For the financialised private sector, the macro context of openness, combined with weakening industry and uncertainty, further facilitates the shedding/liquidation of real assets for financial gains. In terms of the quality of investment, investment in plant and equipment and its corresponding industrial culture, neoliberalism induces dependency through a reduction in the quality of the capital stock (Saad-Filho 2005). It promotes ignorance of engineering and machinery knowhow, which would alternatively, in the transition to socialism, temper the overly entropic rate of social nature. The imported capital asset/technology is consumed or stands for a consumption item rather than a production item. These corrosive symptoms of dependency cannot be detected in the money value of output per worker nor the output capital ratio. As output rises by geopolitical rents or foreign savings (debts), productivity falsely appears high; oddly, Qatar because of high oil revenues ranks as one of the most productive countries (UN 2015). The efficiency of investment per unit of capital, the returns per dollar invested, also falsely appears high. The salient measure, the Incremental Capital Output Ratio – ICOR, or how much does it take in investment to generate an extra unit of output falls, signalling higher efficiency. The interrelated challenge that China tackled

in relation to the productivity-investment nexus and how to steady incremental growth in quality investment is of manifold nature, but I here I list several points.

- Insecurity requires a state as provider of security. A first question arises in how to put back the state in designing and articulating factor inputs with output and the market for such output. The state in China with its overwhelming ownership of productive assets manages the inter-industrial input-output relations at social prices that respect the value of direct producers while guaranteeing growth in industrial investment. State ownership of productive assets is doorway to security because socially designed prices allocate incomes to buttress the security of the working class.

- A related question appertains to industrial culture and the indigenisation of productive knowledge. It may be all fine to measure the real dollar growth in productivity and investment, but the real impetus for development remains how much of this knowledge is home spawned as opposed to borrowed for consumption. In other words, how much of the depreciated capital stock is replaced or refurbished with indigenised as opposed to borrowed know-how would be to zoom in on the inputs of the department that produces the means of production. Such was the real impetus which drove the rise in the national component in the composition of commodities in China.

- Economic growth as per the Chinese model reduces poverty by the degree to which it subsidises and/or reaches the poor in terms jobs, goods and services and/or overall consumption. Not to forget, for China, the peoples’ guns or security are the guarantors of the consumption bundle.

- Tautologically, economic growth and investment are co-determinant. The design of markets, whether within the nation or abroad, creates the demand that may not dampen investment at short intervals. In China, BRP expansion and sound infrastructural projects lay the groundwork for industry to expand, employ more productive techniques and scale up the value chain. The offshoot of that in labour shedding is dealt through parallel expansion of labour-intensive sectors, such as agriculture, other labour social absorbing industries, the arts, etc., and a social criterion for productivity whose scope rewards all round development objectives.

Macro Policy

Macroeconomic policy, as per the Chinese model, is namely about intermediating economic into social wealth. Variously, neoliberalism undermines social efficiency (Gottschalk 2004). It also circumvents the boomerang into developmental payoff of state investment in the social sphere. Yet despite its supposed inefficiency, the IFI-obedient public sector, including indebtedness, grew in size for most of the developing world. Its growth was led by the area of security-infrastructure spending. The efficiency the IFI desire is the sort that disciplines the labour process. Meanwhile, at the behest of the neoliberal class, the public sector spearheaded the wage compression and supposedly the leaner employment crunch. The private sector, in turn, did not fill the void left behind, hence the excess slack in real and human resources. Moreover, the application of indirect taxes as per the directives of the IFI channelled incomes upward and eroded the demand component of the economy. The recipe for austerity is to lock the national currency with the dollar and to tax the economy beyond its capacity in order to fund the peg with the dollar.

Theoretically, the IFIs touted assumption of crowding out as justification to shrink credit to the working class; what is rarely said is that the misery inflicted is a necessary application of the law of value because without which there will be no profits. Moreover, in reality crowding out is a fallacious proposition (Weeks 2014). As typically true of dichotomous fallacies, whatever substantive private investment was there, it piggybacked on public or major state funded projects – it was crowded in.

It is not only that in times of low growth/poor development, the public sector offers a welfare cushion through public employment, but as the functional arm of the state institution, the public sector is the most capitalised institution. Under Chinese-like regulated capital and trade accounts, public investment can be underwritten by national financial resources and state owned banks. Government spending and investment as functions of appropriate monetary policy, expand growth and employment while their costs can be duly monetised. Differently, neoliberalism taps financial resources from savings and tax revenues, retarding the growth employment nexus.

Chinese macro policy, through its state owned development Banks, creates the credit space for economic growth. They fund the linkages between foreign investment and local production through the application of rules to foreign investment by which its returns nest in the area of knowledgeability. Its regulated capital account is key to its success. Contrariwise for most of the developing world, the capital account is open or loosely regulated (Helleiner 2006). The under-priced developing country raw material or unfinished products/inputs shift value for low prices through the open capital account to the developed world. Draining capital from poorer nations amounts in one indicative measure to losses in real or potential life expectancy. Opening the capital accounts in developing/security-exposed states surrenders the control of national finance to the international market (Helleiner 1994). In standard macro analysis and under current account deficits, the national interest rates have to rise to disincentivise outflows, but they also dis-incentivise national capital formation.

Under neoliberalism, finance is shallow for the working population and deep for the globalised class. The former cannot borrow as much as the latter. Credit, the forerunner of economic activity, is either externally controlled or rationed to the working masses. Entrapping the moneyed value within the national economy is the crux of the national security/development nexus. The interaction of the exchange and interest rates in relation to the regulation of the capital account empower the state over the process of money creation and its bearing upon income distribution. Monetary policy is not just about the expansion/contraction of money supply. It is a tool of capital, a manifestation of the law of value, supplying credit to some classes more than others and affecting growth and the income distribution structure.

Unemployment

In a developing context, labour demand is more than just derived demand; it is development derived. In addition to the low growth-poor development cycle, under the private job growth benchmark, unemployment must remain a socio-economic burden. Unemployment is not a supply side problem. There are not too many people relative to spare capacity. Also, the mismatches between skills required by the employers and those provided by job applicants are minor in comparison to the depressive cycle of the product market. Unemployment is cyclical has to be tackled by shifting the productivity benchmark for labour demand from private or abstract, to social. It is best approached as China’s employment policies do. China has re-absorbed much of the working age population under its transformative model of de-alienating technological innovation; hence, relieving the backlog between mechanisation and the creation of superfluous labour through social jobs and social spending.

In the lower-end economies of the global division of labour, war and militarism become the means to create jobs, in which, as I have said above, the labourer simultaneously serves as living and literally as dead labour. The effects of conflict on employment, on the resolution of unemployment by plainly disposing of the unemployed, is natural to capital, but the process accelerates under the neoliberal mantra. The Chinese model of humanising resource deployment, the necessity to include planning schemes tallying employment with existing spare capacity are possible because of the adequate levels of Chinese state ownership and control.

Declining agriculture

The climate calamity, austerity and war uproot people from direct production in agriculture. Just as primitive accumulation did, these measures deracinate and socialise labour and resources on a massive scale. Imperialist wars and wars of colonisation, in particular, uproot and disperse the human and physical assets of whole nations. However, just as the forms of primitive accumulation intensify in different shapes in response to the crisis of capital, so does their key form of exploitation, commercial exploitation, whose striking appearance was slavery in the past and is the capitulated or bombed state in the present. The eradication of sources of independent support for labour, especially in rural areas, is a principal strategy of capital because it caps the independence of the working class. A point of departure would be a discussion of the rate of exodus from the land in China, at a heavy cost to the farming community, and the rate of absorption in decent employment, while wages rise. Such transformation remains under-investigated.

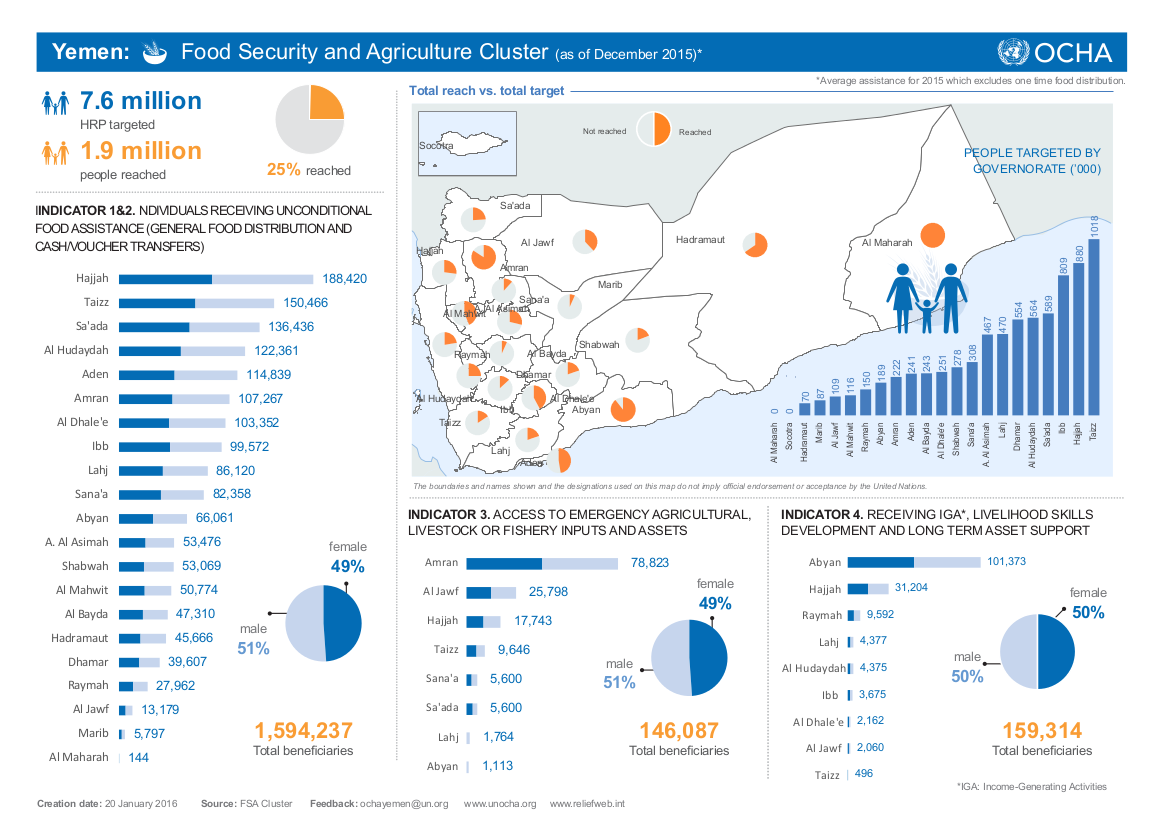

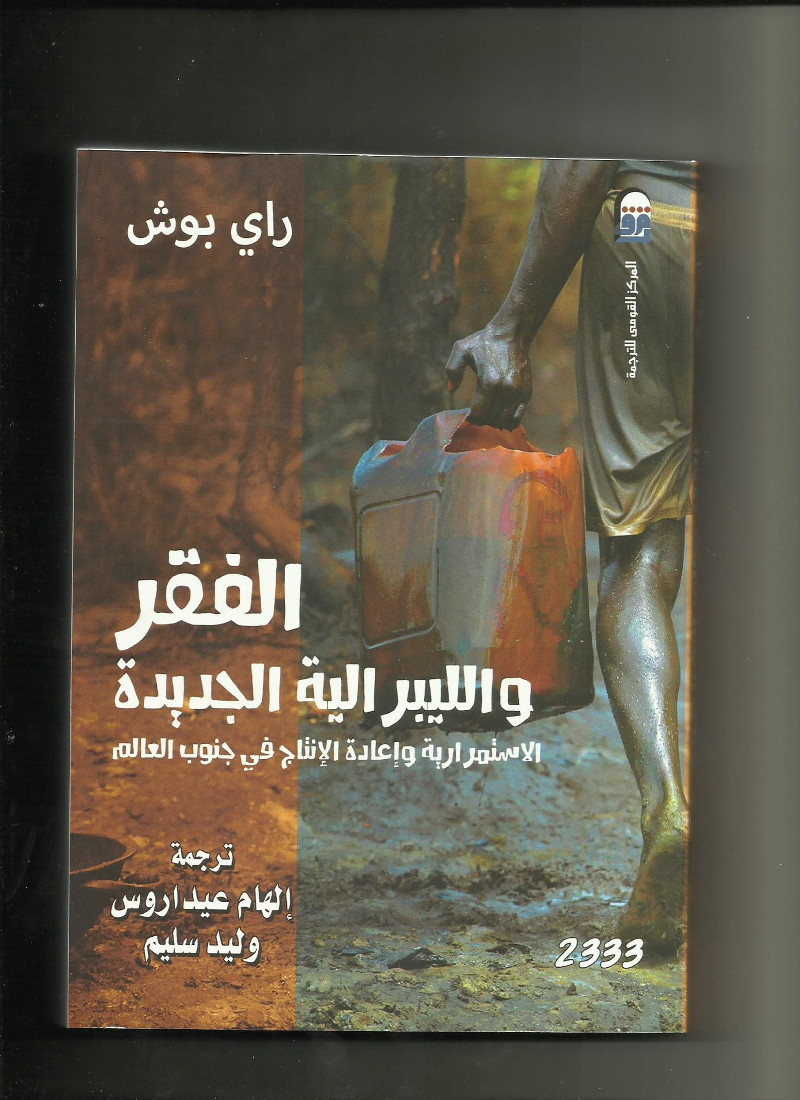

Discussion on the topic of agricultural decline is rarely framed in relation to waste accumulation or to the point that the creation of value occurs in the destruction of idle or active value. True, imports of cheaper agri-products undercut national agriculture (Bernstein 2010). As an offshoot of trade policy, agricultural trade treaties negotiated by the weaker parties compromise food and national securities (Bush 2007). The insecurities are themselves impetuses for an attendant rise in militarism. The context undermining national agriculture is laid down by the law of value as means of immiseration through policies of pegged exchange rate, the single interest rate, and the declining wage bill. The pegged exchange rate may appear to subsidise imported foods, the single interest rate may stay too high to mitigate capital flight or dampen investment, especially in agriculture, and the agricultural incomes may be undermined by rising inflation and weakened rural political organisations, but the appearance of prices are the reified operatives of capital. These are symptoms of the policies associated with capital adhering to the reason of the commodity. They are the economic façade whose social outcome reaccentuates uneven development between metropolis and hinterland. In China, it is the control of these prices that counteracts the decay of rural areas.

Parting comment

Development transpires by power labour exercises in the class struggle, which is the degree of democracy. That China had developed and alleviates poverty is ex-post facto proof that labour votes daily in the state. It is this popular democracy that imparted the autonomy in policy. Control of value flows in money form through capital account control and autonomous industrialisation are the key features of the Chinese development experience. Put in a different way, autonomy is by definition the extent to which people, principally through their state, control the decisions that shape their lives. Elsewhere, the emulation of the European democratic model resulted in a marked absence of democratisation as materialisation of working class power in the state. European democracy itself has evolved as a resource allocation mechanism paying off sections of the working class to solidify capital’s rule and/or expanding empire and imperialism. European welfare states are manifestations of the European circles of capital, which is in its ultimate form a social democracy breeding fascism at home and imperialism abroad (Browder 1933). With whichever means achieved, the forms of working class control over the state are democratic provided they impart positive sum improvement in the living conditions of nationals and extra-nationals, the non-national boundary innate to the definition of an internationalist working class. The reason I say with ‘whichever means possible’ is because violence is, necessarily but not exclusively, a means to combat capital.

Re-distribution is effective by the degree of popular participation, as opposed to political processes, such as ballot box charades destined to rebreed the same capital class. In a developing context often subjected to imperialist assault, the effectiveness of monitoring or embedding the gains from development becomes a learning process that grows by the distance the ruling national class keeps from imperialism, the delinking. Autonomy itself is the decolonisation of development, including a reinvention of the concepts, language and practice of development. Accountability to popular democratic forms of organisation raises the social payoff of redistribution over time. Autonomy is the common thread that holds together the macro themes of sound development through the nationalisation of knowledge and resources.

The question then becomes: why were national institutions non-autonomous and/or why did the national bourgeoisie in so many places betray the national agenda?